In your scenario, though, everyone would pay off their houses and get out of debt. That's not a win for control. I suppose they could inflate and raise confidence then deflate, but deflation would be the only end game that makes sense. I would be interested to hear a scenario where inflation makes the rich richer and the middle class poorer. At best, you're protecting your wealth against inflation.mahalanobis wrote: ↑July 30th, 2020, 9:47 pmIf you are an evil cabal with lots of wealth - and you're trying to increase your wealth while also increasing your control:harakim wrote: ↑July 30th, 2020, 10:06 am Deflation would be great for people with money and terrible for people with debt. If there really is an evil cabal, they want deflation. And with how much debt is out there, just not issuing money would lead to rapid deflation. So if inflation happens, I'll take that as a sign that there is not an evil cabal with control, or else they are going to make the inflation beneficial only if people take the mark of the beast or something else which will give them even MORE power.

You can run up a huge amount of inflation and simply leverage it in your advantage. My point is that if you're in control, you can put your wealth where it will be best protected for whatever economic event you have planned. So it wouldn't matter if it was inflation or deflation.

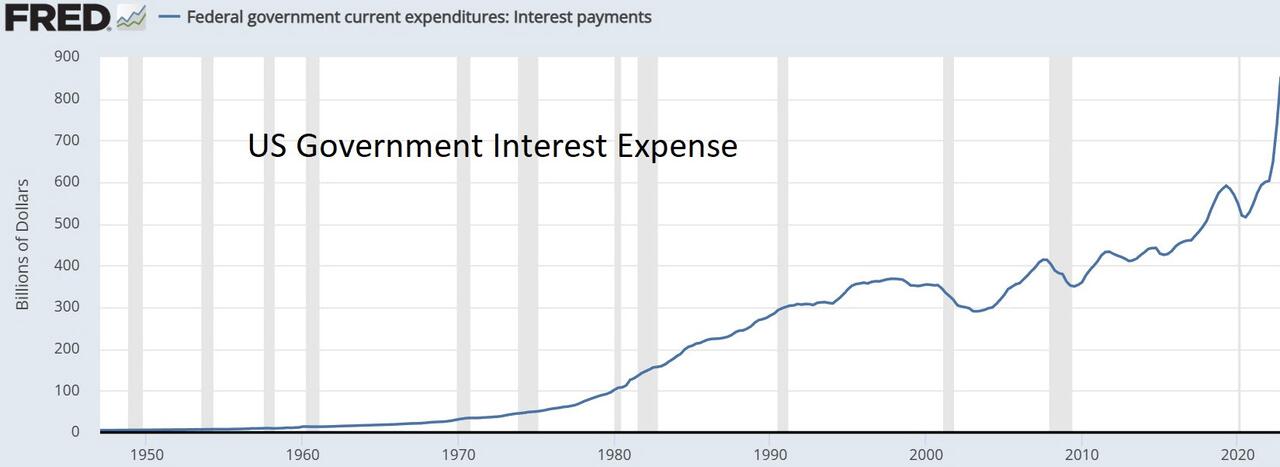

So if the goal was to weaken the US, burden it with debt, then inflate the heck out of the currency... All while protecting your wealth because you know what's coming.

These are hypotheticals of course, I don't have proof.

Inflation vs. Deflation debate

- harakim

- captain of 1,000

- Posts: 2819

- Location: Salt Lake Megalopolis

Re: Inflation vs. Deflation debate

- harakim

- captain of 1,000

- Posts: 2819

- Location: Salt Lake Megalopolis

Re: Inflation vs. Deflation debate

It's true they could have their debt erased, and that might them marginally richer. However, the point of money is influence. You can use it to get people to do what you want. We usually call this control. If your money no longer holds that control, then it doesn't matter how much of it you have. Additionally, there are so many more middle class people than rich, even if they "own" assets, that is meaningless if the middle class isn't controlled.Original_Intent wrote: ↑July 30th, 2020, 5:57 pmYou aren't wrong, but hopefully what I am about to say will give you a paradigm shift.harakim wrote: ↑July 30th, 2020, 10:06 am Deflation would be great for people with money and terrible for people with debt. If there really is an evil cabal, they want deflation. And with how much debt is out there, just not issuing money would lead to rapid deflation. So if inflation happens, I'll take that as a sign that there is not an evil cabal with control, or else they are going to make the inflation beneficial only if people take the mark of the beast or something else which will give them even MORE power.

Inflation is great for people who own stocks, who own real assets, and yes, those who own debt.

Most of the wealthy do not sit on piles of cash. They own equities and other assets that rise exponentially with inflation.

Like I said, deflation will have it's day without a doubt.

Hyperinflation might appear to help the debt serfs, but consider this - with the large unemployment, many are not able to leverage it because they have no income.

The wealthy carry debt that makes the debt we hold look like bread crumbs. They also carry it thru corporations, not personal, so they reap the benefits but if things go sideways (which they will) the corporation suffers, they will cry for bailouts to keep from having to reduce their workforce, and if history is instructor, they will get those bailouts - repeatedly. In the meantime, government will give the struggling relative table scraps to appear to be doing something to help the struggling masses.

All of the above of course is just my opinion, I am not qualified to give financial advice (for instance I never would have guessed the earnings reports for Apple, Facebook, etc. today, I expected the markets to get CRUSHED tomorrow, instead we get magically levitating earnings, I WONDER how that happened?)

If people's houses are paid off, you just lost most of you control. Now, if people run out of food, that adds an interesting element... Thanks for the insight.

- Original_Intent

- Level 34 Illuminated

- Posts: 13077

Re: Inflation vs. Deflation debate

Like I said, even in hyperinflation you can't simply "pay off your mortgage" if you don't have a job.

Which is, for reasons of control, a great reason for the elite to hyperinflate at a time of high unemployment.

Which is, for reasons of control, a great reason for the elite to hyperinflate at a time of high unemployment.

- harakim

- captain of 1,000

- Posts: 2819

- Location: Salt Lake Megalopolis

Re: Inflation vs. Deflation debate

But you could sell something you own, like a car, to pay it off.Original_Intent wrote: ↑July 31st, 2020, 2:15 pm Like I said, even in hyperinflation you can't simply "pay off your mortgage" if you don't have a job.

Which is, for reasons of control, a great reason for the elite to hyperinflate at a time of high unemployment.

- Original_Intent

- Level 34 Illuminated

- Posts: 13077

Re: Inflation vs. Deflation debate

If unemployment is high enough, many people will be doing the same thing for the same reason. This will flood the market with supply and lower how much you can get.harakim wrote: ↑August 3rd, 2020, 7:58 amBut you could sell something you own, like a car, to pay it off.Original_Intent wrote: ↑July 31st, 2020, 2:15 pm Like I said, even in hyperinflation you can't simply "pay off your mortgage" if you don't have a job.

Which is, for reasons of control, a great reason for the elite to hyperinflate at a time of high unemployment.

Also, severe inflation need not go immediately to Zimbabwe or even Venezuela levels. Can you imagine annual inflation being 50% with unemployment of 25%? Foreclosures everywhere, people would be selling their cars to, at best make a year or two of payments, and that is on the off chance that they actually own their car free and clear. What percentage of cars are still having payments made on them?

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

Another perspective...fwiw...Original_Intent wrote: ↑July 30th, 2020, 5:22 pmThe fake coin shortage is to convince people that e-currency is the solution to all of our problems

As far as the meta "inflation vs. deflation" - deflation will definitely have its day in the sun. It's only by alternatively using both that the Fed is able to strip maximum real wealth out of the system.

Currently I think they are making the stock market look like a "no-lose" situation to draw every last "Robin Hooder" (no reference to LDSFF user) in to the honey pot.

Even in deflation I think a few things will retain value. But when it happens expect (imho):

Housing Crash

Equity Crash

Derivative Crash

Unemployment that will make the current situation seem like a Sunday School picnic

Rampant civil unrest leading to massive gun control (I believe they would like to hold off the reset that Glenn speaks of until they have most of the guns.)

At that point, I hope you have figured out a way to produce most of what you need or offer some value via service. It won;t be pretty for useless eaters at that point.

I wonder if the efforts to keep the stock market inflated are not aimed at the baby boomers in order to keep a stable base going into the Great Reset??? No discredit to the Robinhooders...but they are financial gnats. The primary fear factor pushing the Reset along is Covid-19 which again is primarily a factor for the older generations. If they can keep the financial retirement pot water lukewarm while using the virus to push things along....

Gotta keep some balance to the wheel barrel as the Fed pretends to be the Swede in crossing the Niagara Falls on a tightrope...

Anyways my take on it at the moment...

- Original_Intent

- Level 34 Illuminated

- Posts: 13077

Re: Inflation vs. Deflation debate

Thanks Glenn. I really enjoy your insights!

With covid, I truly believe a "mark of the beast" system is going to be implemented with the vaccine.

To sweeten the pot, I could even see a "limited time offer" that early adopters would either get some kind of debt forgiveness or credit in the new monetary system for getting the vaccine. Along with the ability to buy and sell.

They are willing to forgive debt on Monopoly money in order to increase power.

I believe people that refuse the vaccine are going to go thru some very challenging times, but my feeling is that getting the vaccine is going to be a big mistake.

With covid, I truly believe a "mark of the beast" system is going to be implemented with the vaccine.

To sweeten the pot, I could even see a "limited time offer" that early adopters would either get some kind of debt forgiveness or credit in the new monetary system for getting the vaccine. Along with the ability to buy and sell.

They are willing to forgive debt on Monopoly money in order to increase power.

I believe people that refuse the vaccine are going to go thru some very challenging times, but my feeling is that getting the vaccine is going to be a big mistake.

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

The only inflation I'm seeing across a class of assets is necessities...primarily food...although toilet paper is still disappearing off the shelf at a pretty good rate. Guns & ammo across the board are 20-30% higher than December. Housing is a mixed bag despite historical bottom in interest rates. What I'm seeing there (perhaps my lens is dirty) is people fleeing from apartments to suburbs and from suburbs to rural. In some areas fleeing from the city or state as a whole.

If you live in Illinois prices are where they were 20 years ago. If you live in a destination area...they are climbing rapidly. For example, 900 sq ft houses on the bench in Boise Idaho going for $400k+...

For example...the wait time to get a Uhaul in Illinois used to be 3 weeks...I don't know where it is today but I understand its only getting worse as people are leaving the state. California isn't as bad but headed in that direction. New York, New Jersey, etc etc etc

When the insurance actuaries cut coverage or freeze coverage in cities like Minneapolis, Seattle, Portland, etc...with no warning...as votes to defund police transpire....banks won't or cannot write mortgages...thus locking up assets and/or collapsing prices. Like Lehi leaving with some basic necessities...

I know there is a general movement towards the rocky mountains...which I believe has been prophesied and likely is still in the very early stages...

The other aspect to this to keep in mind is that business costs have accelerated. From implementing social distancing measures, to supply chain disruptions, to government mandated pay to employees at home, etc etc etc. So is the inflation a result of a monetary stimulus or a regulatory one or a supply issue or a temporary increase in demand?

For example we've seen a collapse in fuel prices due to collapse in demand. But this certainly isn't monetary deflation. Nor will it be monetary inflation when the price comes back up after demand comes back on line.

That is the challenge on the economics side...sorting through all of it to determine what the baseline monetary action is...

When you experience something like this - https://twitter.com/febewolde/status/12 ... 8141696000

or this

https://www.cbsnews.com/news/mark-patri ... rotesters/

What sort of stimulus will it take to move? Will you be waiting for the highest bidder? Or the first offer? Or just leave the keys in the mailbox and beat feet out?

Or will it be like in the days of Ether when you slept on your sword and kept all your assets in-hand...or pretty much they were gone come morning...

https://www.zerohedge.com/political/car ... os-angeles

Probably won't care about the inflation/deflation debate at that point...

If you live in Illinois prices are where they were 20 years ago. If you live in a destination area...they are climbing rapidly. For example, 900 sq ft houses on the bench in Boise Idaho going for $400k+...

For example...the wait time to get a Uhaul in Illinois used to be 3 weeks...I don't know where it is today but I understand its only getting worse as people are leaving the state. California isn't as bad but headed in that direction. New York, New Jersey, etc etc etc

When the insurance actuaries cut coverage or freeze coverage in cities like Minneapolis, Seattle, Portland, etc...with no warning...as votes to defund police transpire....banks won't or cannot write mortgages...thus locking up assets and/or collapsing prices. Like Lehi leaving with some basic necessities...

I know there is a general movement towards the rocky mountains...which I believe has been prophesied and likely is still in the very early stages...

The other aspect to this to keep in mind is that business costs have accelerated. From implementing social distancing measures, to supply chain disruptions, to government mandated pay to employees at home, etc etc etc. So is the inflation a result of a monetary stimulus or a regulatory one or a supply issue or a temporary increase in demand?

For example we've seen a collapse in fuel prices due to collapse in demand. But this certainly isn't monetary deflation. Nor will it be monetary inflation when the price comes back up after demand comes back on line.

That is the challenge on the economics side...sorting through all of it to determine what the baseline monetary action is...

When you experience something like this - https://twitter.com/febewolde/status/12 ... 8141696000

or this

https://www.cbsnews.com/news/mark-patri ... rotesters/

What sort of stimulus will it take to move? Will you be waiting for the highest bidder? Or the first offer? Or just leave the keys in the mailbox and beat feet out?

Or will it be like in the days of Ether when you slept on your sword and kept all your assets in-hand...or pretty much they were gone come morning...

https://www.zerohedge.com/political/car ... os-angeles

Probably won't care about the inflation/deflation debate at that point...

Last edited by Jason on August 3rd, 2020, 11:28 am, edited 2 times in total.

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

Thank you! I feel the same way about your perspective!Original_Intent wrote: ↑August 3rd, 2020, 10:39 am Thanks Glenn. I really enjoy your insights!

With covid, I truly believe a "mark of the beast" system is going to be implemented with the vaccine.

To sweeten the pot, I could even see a "limited time offer" that early adopters would either get some kind of debt forgiveness or credit in the new monetary system for getting the vaccine. Along with the ability to buy and sell.

They are willing to forgive debt on Monopoly money in order to increase power.

I believe people that refuse the vaccine are going to go thru some very challenging times, but my feeling is that getting the vaccine is going to be a big mistake.

I certainly don't know the details of the Reset. I think we'll get some more transparency in Jan 2021 with the next World Economic Forum meeting as they distill next steps. That said...probably a day late and a US dollar short.

For example, if you were aware and knowledgeable concerning Event201 last October sponsored by Bill Gates Foundation, World Economic Forum, and Johns Hopkins...would you have had enough insight to prepare for Covid-19 in Jan/Feb/Mar of this year???

Certainly challenging times. Yeah there will be a contact tracing element of the vaccine...DARPA and subcontractors are hard at work on it. Like you mentioned...likely some sort of incentive for transitioning over. Whether its reduction in debt, partial reduction, delayed payment program, free vaccine shot, some "free" credits, etc...

But they are pipsqueaks...

The BIG question though is...what steps will God take? 70 lb hail stones? floods? earthquakes? hurricanes? tornadoes? fire?

- harakim

- captain of 1,000

- Posts: 2819

- Location: Salt Lake Megalopolis

Re: Inflation vs. Deflation debate

If you consider that hyperinflation, then something like 50% inflation and 50% unemployment is a scenario that makes sense.Original_Intent wrote: ↑August 3rd, 2020, 9:22 amIf unemployment is high enough, many people will be doing the same thing for the same reason. This will flood the market with supply and lower how much you can get.harakim wrote: ↑August 3rd, 2020, 7:58 amBut you could sell something you own, like a car, to pay it off.Original_Intent wrote: ↑July 31st, 2020, 2:15 pm Like I said, even in hyperinflation you can't simply "pay off your mortgage" if you don't have a job.

Which is, for reasons of control, a great reason for the elite to hyperinflate at a time of high unemployment.

Also, severe inflation need not go immediately to Zimbabwe or even Venezuela levels. Can you imagine annual inflation being 50% with unemployment of 25%? Foreclosures everywhere, people would be selling their cars to, at best make a year or two of payments, and that is on the off chance that they actually own their car free and clear. What percentage of cars are still having payments made on them?

- Sarah

- Level 34 Illuminated

- Posts: 6727

Re: Inflation vs. Deflation debate

I have, or copied, an old post over 10 years ago, by an LDS Man, who described a vision he had where he saw a time where there was 40% unemployment, prices were high for items that everyone needed, no one could sell their house or car. Some banks were failing, and people simply continued to live in their homes after they were foreclosed on because they had nowhere else to go. Sounds like what we could be headed into.

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

Headed into?Sarah wrote: ↑August 3rd, 2020, 1:28 pm I have, or copied, an old post over 10 years ago, by an LDS Man, who described a vision he had where he saw a time where there was 40% unemployment, prices were high for items that everyone needed, no one could sell their house or car. Some banks were failing, and people simply continued to live in their homes after they were foreclosed on because they had nowhere else to go. Sounds like what we could be headed into.

We are there now in terms of unemployment, high prices for necessities, etc. Banks on the verge of failing.

It's Now Virtually Impossible To Get A Bank Loan As Lending Standards Soar

https://www.zerohedge.com/markets/its-n ... dards-soar

But I personally know people who lived in their homes without making payments for 3 years or more following 2008 collapse...in terms of prophecies...

- BeNotDeceived

- Agent38

- Posts: 9058

- Location: Tralfamadore

- Contact:

Re: Inflation vs. Deflation debate

Jason wrote: ↑September 26th, 2011, 2:09 pmhttp://www.opednews.com/articles/2/Assu ... 4-756.html" onclick="window.open(this.href);return false;Banks create money as loan principal, but they create repayment obligations ("debt") as principal + interest. The loan principal that is spent into the economy by borrowers becomes the economy's "money supply". So loan principal = money supply, and money supply < debt. Our system systematically generates more debt than it creates money to pay that debt. This is a STUPID money system.

Our privately owned system of issuing all the economy's money as debt at interest is a pure Ponzi, because it requires the constant addition of new borrowers spending additional new money to keep up the appearance that this system 'works'. Simple arithmetic shows it CANNOT work, and the fact that our money system is arithmetically defective explains the current global debt crisis, as proponents of modern money theory (MMT) never tire of showing all whose ears are open to listen and whose eyes are open to see.

Our profit seeking economic system systematically generates more prices than it generates incomes to pay those prices. Our bank-debt money system systematically generates more debt than it creates money to pay that debt. We all need to "profit" so it is error to try to alter that fact of reality by various 'socialist' anti-profit schemes. We must accommodate our economic reality by modifying our money system so that it becomes positive sum like our economic system. Somebody needs to add non-debt money into the spending-cum-income equation, so that income earners have enough money to buy all the economy's outputs at prices that are profitable to producers.

Clearly, the bankers in our private for-profit money system are not going to start giving money to people. Bankers are in the business of "lending" money at interest, for the sake of getting back more money than they put out. Only a government with the power to create debt-free money is able to perform the financially necessary function of adding non-debt money to make our money system positive sum.

As Jamie Galbraith explains in his 2008 book, "The Predator State", the Chinese are doing this in a clever way that seems to be working. Unlike virtually the entire hopeless world whose nations have surrendered their monetary sovereignty to the private bankers, the Chinese government has retained ownership of its money and banking system. The government tells the banks to lend to producers, and the producers use the money to hire workers and produce stuff. This puts incomes into the hands of the workers and the entrepreneurs, who then have money to buy stuff. But like us, they can't buy "all" the stuff at profitable prices, so excess stuff is hauled to discounters who sell it to happy Chinese consumers at a fraction of its cost price"

We are not going to adopt the Chinese monetary model so we need alternate means of making our system positive sum. One way or another, our governments have to create their own debt-free money and spend or otherwise distribute it into our economies where it becomes incomes in the hands of recipients. Robert Reich advocates renewed fiscal stimulus funded by more deficit spending. But Republicans will not continue to raise the debt ceiling, and it is stupid for the government to continue "borrowing" money that it has the Constitutional authority to create for itself debt-free.

In 1996 Congress passed legislation authorizing the government to issue proof platinum coins of "arbitrary" face value, which means the face value is not related to the metal content of the coins. The government could issue a $2 trillion coin (for example), deposit that coin in its account at the Federal Reserve, and the Fed would credit the government's account with a $2 trillion deposit of "money".

That is how our banks create our money, by creating "deposits". We sign a promissory note saying we will repay the loan principal + interest, and the bank creates the loan by adding a deposit to our bank account in the amount of the loan principal. Our promissory notes are our "debts", but to the banks those same notes are their "assets". Banks, including the Fed, are authorized to "purchase assets" with newly created deposit money. That's how the primary dealer banks buy Treasury debt. The government signs a promissory note, a "bond", and the bank who buys it creates a deposit in Treasury's account at that bank. A $2 trillion platinum coin is an "asset", and the Fed is authorized to buy such assets by creating deposits. Except the coin is not "debt" to the government, whereas selling Treasuries to the banks is debt, which adds to the debt ceiling, which Republicans will not allow.

So the government already has a legal mechanism in place to create all the money it needs debt free. Joe Firestone makes the case that this is exactly what should be done. I heartily agree.

...couple that knowledge/understanding of the money creation system with this outlook -

http://www.youtube.com/v/aC19fEqR5bA

....as well as the recent triggers that have been pulled -

http://www.zerohedge.com/contributed/sp ... and-diesel" onclick="window.open(this.href);return false;Crude oil tanked to its lowest in more than six weeks, amid a broad selloff in other commodities and equities with investors increasing fear of another global recession after the U.S. Federal Reservewarnedof "significant downside risks" to the U.S. economy on Thursday, Sept. 22. Oil prices plunged $5.00 a barrel on that day, and as of Friday, Sept. 23, WTI sank to $79.96 a barrel, while the ever relentless Brent also retreated to $103.97.

Market expectation is that crude oil prices are expected to continue to fall in the coming week on concern economic growth will slow in the U.S. and China, according to a Bloomberg survey.

People are freaking out that gold has fallen to $1,650, from its lofty highs above $1,800—they are freaking out something awful. “Gold has fallen 10%! The world is coming to an end!!!” I myself took a shellacking in gold—

—but copper is what has me worried.

Copper fell from $4.20 to $3.25—close to 25%—in about three weeks. Most of that tumble has happened in the last ten days, and what’s worrisome is that, as I write these words over the weekend, there is every indication that copper will continue its free fall come Monday.

From the numbers that I’m seeing—and from the historical fact that copper tends to fall roughly 40% from peak to trough during an American recession—there is every indication that copper could reach $2.67 in short order. And even bottom out below that—say at $2.20—before stabilizing around the $2.67 level.

But we’ll see. The price of copper is not the point of this discussion. The point of this discussion is what the price of copper means.

What it means for monetary policy.

We all know the old saying: “Copper is the only commodity with a Ph.D. in economics”, or words to the effect.

The ongoing price collapse of copper signals that the markets have collectively decided that there is going to be no resurgence of the global economies—at least not for the next 9 to 18 months. Up until now, the economic data that has been coming out over the last couple of weeks seemed to indicate that there’s going to be a double-dip—but in my mind, this fall in the price of copper confirms this notion that the general economy is going down.

http://www.zerohedge.com/news/guest-pos ... ers-copper" onclick="window.open(this.href);return false;

Latest and greatest on copper -

http://www.kitcometals.com/charts/coppe ... large.html" onclick="window.open(this.href);return false;

Aluminum (look at 60 day, 6 month, 1 year, and 5 year charts to analyze the trend) -

http://www.kitcometals.com/charts/alumi ... rical.html" onclick="window.open(this.href);return false;

Nickel (same) -

http://www.kitcometals.com/charts/nicke ... rical.html" onclick="window.open(this.href);return false;

Lead (same) -

http://www.kitcometals.com/charts/lead_historical.html" onclick="window.open(this.href);return false;

Zinc (same) -

http://www.kitcometals.com/charts/zinc_historical.html" onclick="window.open(this.href);return false;

...coupled with this knowledge

Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly

http://www.zerohedge.com/article/goldma ... d-monopoly" onclick="window.open(this.href);return false;

Hedge funds look for a golden edge

http://www.ft.com/cms/s/0/f1b2691e-8b80 ... z1Z60lWLrK" onclick="window.open(this.href);return false;

Analysis: Hedge funds catch new wave in commodities

http://www.reuters.com/article/2010/10/ ... O720101001" onclick="window.open(this.href);return false;

Hedge Funds, Institutions to Increase Commodity Investments, Barclays Says

http://www.bloomberg.com/news/2010-12-0 ... -says.html" onclick="window.open(this.href);return false;

...so while the economy has spiraled down since 2008 (falling demand despite China's empty cities)....the investment funds have played games until the writing is clearly on the wall and we are about to hit the next big wave in deflation picking up where we left off in 2008. The PM groupies will take it as a buying opportunity - best o'luck to them. I have a sneaking suspicion though that the buying opportunity (value of FRNs to PMs) will be much much better in 6-12 months. What are people going to pay back their debt with??? gold/silver....that would be a negative. Sure they can exchange the gold/silver for dollars....but the debt must be satisfied in dollars. Just like the European Central bank borrowing dollars to shore up liquidity. When it comes time to satisfy the debt.....gonna be ugly. There will be a Day of Reckoning on debt!

Again catch the comments at the end of the video....

- Original_Intent

- Level 34 Illuminated

- Posts: 13077

Re: Inflation vs. Deflation debate

I now take the position that they can move things either direction, and will make the move that will best enrich them and rob the vast majority.

They can "stimmy" us into hyperinflation, be seen to be "helping the poor" (which they have made most people) this will lead to more dependence, more looking to Big Brother to take care of them and the delayed price to pay is less productivity and even higher prices. This the the inflation path (they can also continue to print money and keep the stock market, the housing market, etc. inflated.

Or they can stick to higher rates without pivoting. This will destroy the stock market and eventually the housing market bubble will pop again. This is all goo in my opinion, but it means there will be far less money in circulation and everyone that has massive debt will not be able to make payments either to being unemployed or being under-employed. Zombie companies will fail as cheap money has been the only thing keeping them functioning. And the elite who have gotten out of stocks and have cash side-lined will be able to come back in and buy up hones, equities etc. for pennies on the dollar.

Frankly I see them using volatility and swinging rapidly back and forth (as the populace demands first one fix, then another AS THEY ARE GUIDED TO DO BY THE MEDIA.) I mean they can crush us on both the upswing and the downswing - THAT is the crucial thing that must be understood and prepared against. Stop playing THEIR game. I can't give financial advice and don't want to other than I would say prayerfully get your house in order as best you can.

They can "stimmy" us into hyperinflation, be seen to be "helping the poor" (which they have made most people) this will lead to more dependence, more looking to Big Brother to take care of them and the delayed price to pay is less productivity and even higher prices. This the the inflation path (they can also continue to print money and keep the stock market, the housing market, etc. inflated.

Or they can stick to higher rates without pivoting. This will destroy the stock market and eventually the housing market bubble will pop again. This is all goo in my opinion, but it means there will be far less money in circulation and everyone that has massive debt will not be able to make payments either to being unemployed or being under-employed. Zombie companies will fail as cheap money has been the only thing keeping them functioning. And the elite who have gotten out of stocks and have cash side-lined will be able to come back in and buy up hones, equities etc. for pennies on the dollar.

Frankly I see them using volatility and swinging rapidly back and forth (as the populace demands first one fix, then another AS THEY ARE GUIDED TO DO BY THE MEDIA.) I mean they can crush us on both the upswing and the downswing - THAT is the crucial thing that must be understood and prepared against. Stop playing THEIR game. I can't give financial advice and don't want to other than I would say prayerfully get your house in order as best you can.

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

Make a few of those coins...hand them out to the debt holders and wish them luck!BeNotDeceived wrote: ↑January 27th, 2023, 4:09 pmJason wrote: ↑September 26th, 2011, 2:09 pmhttp://www.opednews.com/articles/2/Assu ... 4-756.html" onclick="window.open(this.href);return false;Banks create money as loan principal, but they create repayment obligations ("debt") as principal + interest. The loan principal that is spent into the economy by borrowers becomes the economy's "money supply". So loan principal = money supply, and money supply < debt. Our system systematically generates more debt than it creates money to pay that debt. This is a STUPID money system.

Our privately owned system of issuing all the economy's money as debt at interest is a pure Ponzi, because it requires the constant addition of new borrowers spending additional new money to keep up the appearance that this system 'works'. Simple arithmetic shows it CANNOT work, and the fact that our money system is arithmetically defective explains the current global debt crisis, as proponents of modern money theory (MMT) never tire of showing all whose ears are open to listen and whose eyes are open to see.

Our profit seeking economic system systematically generates more prices than it generates incomes to pay those prices. Our bank-debt money system systematically generates more debt than it creates money to pay that debt. We all need to "profit" so it is error to try to alter that fact of reality by various 'socialist' anti-profit schemes. We must accommodate our economic reality by modifying our money system so that it becomes positive sum like our economic system. Somebody needs to add non-debt money into the spending-cum-income equation, so that income earners have enough money to buy all the economy's outputs at prices that are profitable to producers.

Clearly, the bankers in our private for-profit money system are not going to start giving money to people. Bankers are in the business of "lending" money at interest, for the sake of getting back more money than they put out. Only a government with the power to create debt-free money is able to perform the financially necessary function of adding non-debt money to make our money system positive sum.

As Jamie Galbraith explains in his 2008 book, "The Predator State", the Chinese are doing this in a clever way that seems to be working. Unlike virtually the entire hopeless world whose nations have surrendered their monetary sovereignty to the private bankers, the Chinese government has retained ownership of its money and banking system. The government tells the banks to lend to producers, and the producers use the money to hire workers and produce stuff. This puts incomes into the hands of the workers and the entrepreneurs, who then have money to buy stuff. But like us, they can't buy "all" the stuff at profitable prices, so excess stuff is hauled to discounters who sell it to happy Chinese consumers at a fraction of its cost price"

We are not going to adopt the Chinese monetary model so we need alternate means of making our system positive sum. One way or another, our governments have to create their own debt-free money and spend or otherwise distribute it into our economies where it becomes incomes in the hands of recipients. Robert Reich advocates renewed fiscal stimulus funded by more deficit spending. But Republicans will not continue to raise the debt ceiling, and it is stupid for the government to continue "borrowing" money that it has the Constitutional authority to create for itself debt-free.

In 1996 Congress passed legislation authorizing the government to issue proof platinum coins of "arbitrary" face value, which means the face value is not related to the metal content of the coins. The government could issue a $2 trillion coin (for example), deposit that coin in its account at the Federal Reserve, and the Fed would credit the government's account with a $2 trillion deposit of "money".

That is how our banks create our money, by creating "deposits". We sign a promissory note saying we will repay the loan principal + interest, and the bank creates the loan by adding a deposit to our bank account in the amount of the loan principal. Our promissory notes are our "debts", but to the banks those same notes are their "assets". Banks, including the Fed, are authorized to "purchase assets" with newly created deposit money. That's how the primary dealer banks buy Treasury debt. The government signs a promissory note, a "bond", and the bank who buys it creates a deposit in Treasury's account at that bank. A $2 trillion platinum coin is an "asset", and the Fed is authorized to buy such assets by creating deposits. Except the coin is not "debt" to the government, whereas selling Treasuries to the banks is debt, which adds to the debt ceiling, which Republicans will not allow.

So the government already has a legal mechanism in place to create all the money it needs debt free. Joe Firestone makes the case that this is exactly what should be done. I heartily agree.

...couple that knowledge/understanding of the money creation system with this outlook -

http://www.youtube.com/v/aC19fEqR5bA

....as well as the recent triggers that have been pulled -

http://www.zerohedge.com/contributed/sp ... and-diesel" onclick="window.open(this.href);return false;Crude oil tanked to its lowest in more than six weeks, amid a broad selloff in other commodities and equities with investors increasing fear of another global recession after the U.S. Federal Reservewarnedof "significant downside risks" to the U.S. economy on Thursday, Sept. 22. Oil prices plunged $5.00 a barrel on that day, and as of Friday, Sept. 23, WTI sank to $79.96 a barrel, while the ever relentless Brent also retreated to $103.97.

Market expectation is that crude oil prices are expected to continue to fall in the coming week on concern economic growth will slow in the U.S. and China, according to a Bloomberg survey.

People are freaking out that gold has fallen to $1,650, from its lofty highs above $1,800—they are freaking out something awful. “Gold has fallen 10%! The world is coming to an end!!!” I myself took a shellacking in gold—

—but copper is what has me worried.

Copper fell from $4.20 to $3.25—close to 25%—in about three weeks. Most of that tumble has happened in the last ten days, and what’s worrisome is that, as I write these words over the weekend, there is every indication that copper will continue its free fall come Monday.

From the numbers that I’m seeing—and from the historical fact that copper tends to fall roughly 40% from peak to trough during an American recession—there is every indication that copper could reach $2.67 in short order. And even bottom out below that—say at $2.20—before stabilizing around the $2.67 level.

But we’ll see. The price of copper is not the point of this discussion. The point of this discussion is what the price of copper means.

What it means for monetary policy.

We all know the old saying: “Copper is the only commodity with a Ph.D. in economics”, or words to the effect.

The ongoing price collapse of copper signals that the markets have collectively decided that there is going to be no resurgence of the global economies—at least not for the next 9 to 18 months. Up until now, the economic data that has been coming out over the last couple of weeks seemed to indicate that there’s going to be a double-dip—but in my mind, this fall in the price of copper confirms this notion that the general economy is going down.

http://www.zerohedge.com/news/guest-pos ... ers-copper" onclick="window.open(this.href);return false;

Latest and greatest on copper -

http://www.kitcometals.com/charts/coppe ... large.html" onclick="window.open(this.href);return false;

Aluminum (look at 60 day, 6 month, 1 year, and 5 year charts to analyze the trend) -

http://www.kitcometals.com/charts/alumi ... rical.html" onclick="window.open(this.href);return false;

Nickel (same) -

http://www.kitcometals.com/charts/nicke ... rical.html" onclick="window.open(this.href);return false;

Lead (same) -

http://www.kitcometals.com/charts/lead_historical.html" onclick="window.open(this.href);return false;

Zinc (same) -

http://www.kitcometals.com/charts/zinc_historical.html" onclick="window.open(this.href);return false;

...coupled with this knowledge

Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly

http://www.zerohedge.com/article/goldma ... d-monopoly" onclick="window.open(this.href);return false;

Hedge funds look for a golden edge

http://www.ft.com/cms/s/0/f1b2691e-8b80 ... z1Z60lWLrK" onclick="window.open(this.href);return false;

Analysis: Hedge funds catch new wave in commodities

http://www.reuters.com/article/2010/10/ ... O720101001" onclick="window.open(this.href);return false;

Hedge Funds, Institutions to Increase Commodity Investments, Barclays Says

http://www.bloomberg.com/news/2010-12-0 ... -says.html" onclick="window.open(this.href);return false;

...so while the economy has spiraled down since 2008 (falling demand despite China's empty cities)....the investment funds have played games until the writing is clearly on the wall and we are about to hit the next big wave in deflation picking up where we left off in 2008. The PM groupies will take it as a buying opportunity - best o'luck to them. I have a sneaking suspicion though that the buying opportunity (value of FRNs to PMs) will be much much better in 6-12 months. What are people going to pay back their debt with??? gold/silver....that would be a negative. Sure they can exchange the gold/silver for dollars....but the debt must be satisfied in dollars. Just like the European Central bank borrowing dollars to shore up liquidity. When it comes time to satisfy the debt.....gonna be ugly. There will be a Day of Reckoning on debt!

Again catch the comments at the end of the video....

- BeNotDeceived

- Agent38

- Posts: 9058

- Location: Tralfamadore

- Contact:

Re: Inflation vs. Deflation debate

Jason wrote: ↑January 27th, 2023, 6:27 pmMake a few of those coins...hand them out to the debt holders and wish them luck!BeNotDeceived wrote: ↑January 27th, 2023, 4:09 pmJason wrote: ↑September 26th, 2011, 2:09 pmhttp://www.opednews.com/articles/2/Assu ... 4-756.html" onclick="window.open(this.href);return false;Banks create money as loan principal, but they create repayment obligations ("debt") as principal + interest. The loan principal that is spent into the economy by borrowers becomes the economy's "money supply". So loan principal = money supply, and money supply < debt. Our system systematically generates more debt than it creates money to pay that debt. This is a STUPID money system.

Our privately owned system of issuing all the economy's money as debt at interest is a pure Ponzi, because it requires the constant addition of new borrowers spending additional new money to keep up the appearance that this system 'works'. Simple arithmetic shows it CANNOT work, and the fact that our money system is arithmetically defective explains the current global debt crisis, as proponents of modern money theory (MMT) never tire of showing all whose ears are open to listen and whose eyes are open to see.

Our profit seeking economic system systematically generates more prices than it generates incomes to pay those prices. Our bank-debt money system systematically generates more debt than it creates money to pay that debt. We all need to "profit" so it is error to try to alter that fact of reality by various 'socialist' anti-profit schemes. We must accommodate our economic reality by modifying our money system so that it becomes positive sum like our economic system. Somebody needs to add non-debt money into the spending-cum-income equation, so that income earners have enough money to buy all the economy's outputs at prices that are profitable to producers.

Clearly, the bankers in our private for-profit money system are not going to start giving money to people. Bankers are in the business of "lending" money at interest, for the sake of getting back more money than they put out. Only a government with the power to create debt-free money is able to perform the financially necessary function of adding non-debt money to make our money system positive sum.

As Jamie Galbraith explains in his 2008 book, "The Predator State", the Chinese are doing this in a clever way that seems to be working. Unlike virtually the entire hopeless world whose nations have surrendered their monetary sovereignty to the private bankers, the Chinese government has retained ownership of its money and banking system. The government tells the banks to lend to producers, and the producers use the money to hire workers and produce stuff. This puts incomes into the hands of the workers and the entrepreneurs, who then have money to buy stuff. But like us, they can't buy "all" the stuff at profitable prices, so excess stuff is hauled to discounters who sell it to happy Chinese consumers at a fraction of its cost price"

We are not going to adopt the Chinese monetary model so we need alternate means of making our system positive sum. One way or another, our governments have to create their own debt-free money and spend or otherwise distribute it into our economies where it becomes incomes in the hands of recipients. Robert Reich advocates renewed fiscal stimulus funded by more deficit spending. But Republicans will not continue to raise the debt ceiling, and it is stupid for the government to continue "borrowing" money that it has the Constitutional authority to create for itself debt-free.

In 1996 Congress passed legislation authorizing the government to issue proof platinum coins of "arbitrary" face value, which means the face value is not related to the metal content of the coins. The government could issue a $2 trillion coin (for example), deposit that coin in its account at the Federal Reserve, and the Fed would credit the government's account with a $2 trillion deposit of "money".

That is how our banks create our money, by creating "deposits". We sign a promissory note saying we will repay the loan principal + interest, and the bank creates the loan by adding a deposit to our bank account in the amount of the loan principal. Our promissory notes are our "debts", but to the banks those same notes are their "assets". Banks, including the Fed, are authorized to "purchase assets" with newly created deposit money. That's how the primary dealer banks buy Treasury debt. The government signs a promissory note, a "bond", and the bank who buys it creates a deposit in Treasury's account at that bank. A $2 trillion platinum coin is an "asset", and the Fed is authorized to buy such assets by creating deposits. Except the coin is not "debt" to the government, whereas selling Treasuries to the banks is debt, which adds to the debt ceiling, which Republicans will not allow.

So the government already has a legal mechanism in place to create all the money it needs debt free. Joe Firestone makes the case that this is exactly what should be done. I heartily agree.

...couple that knowledge/understanding of the money creation system with this outlook -

http://www.youtube.com/v/aC19fEqR5bA

....as well as the recent triggers that have been pulled -

http://www.zerohedge.com/contributed/sp ... and-diesel" onclick="window.open(this.href);return false;Crude oil tanked to its lowest in more than six weeks, amid a broad selloff in other commodities and equities with investors increasing fear of another global recession after the U.S. Federal Reservewarnedof "significant downside risks" to the U.S. economy on Thursday, Sept. 22. Oil prices plunged $5.00 a barrel on that day, and as of Friday, Sept. 23, WTI sank to $79.96 a barrel, while the ever relentless Brent also retreated to $103.97.

Market expectation is that crude oil prices are expected to continue to fall in the coming week on concern economic growth will slow in the U.S. and China, according to a Bloomberg survey.

People are freaking out that gold has fallen to $1,650, from its lofty highs above $1,800—they are freaking out something awful. “Gold has fallen 10%! The world is coming to an end!!!” I myself took a shellacking in gold—

—but copper is what has me worried.

Copper fell from $4.20 to $3.25—close to 25%—in about three weeks. Most of that tumble has happened in the last ten days, and what’s worrisome is that, as I write these words over the weekend, there is every indication that copper will continue its free fall come Monday.

From the numbers that I’m seeing—and from the historical fact that copper tends to fall roughly 40% from peak to trough during an American recession—there is every indication that copper could reach $2.67 in short order. And even bottom out below that—say at $2.20—before stabilizing around the $2.67 level.

But we’ll see. The price of copper is not the point of this discussion. The point of this discussion is what the price of copper means.

What it means for monetary policy.

We all know the old saying: “Copper is the only commodity with a Ph.D. in economics”, or words to the effect.

The ongoing price collapse of copper signals that the markets have collectively decided that there is going to be no resurgence of the global economies—at least not for the next 9 to 18 months. Up until now, the economic data that has been coming out over the last couple of weeks seemed to indicate that there’s going to be a double-dip—but in my mind, this fall in the price of copper confirms this notion that the general economy is going down.

http://www.zerohedge.com/news/guest-pos ... ers-copper" onclick="window.open(this.href);return false;

Latest and greatest on copper -

http://www.kitcometals.com/charts/coppe ... large.html" onclick="window.open(this.href);return false;

Aluminum (look at 60 day, 6 month, 1 year, and 5 year charts to analyze the trend) -

http://www.kitcometals.com/charts/alumi ... rical.html" onclick="window.open(this.href);return false;

Nickel (same) -

http://www.kitcometals.com/charts/nicke ... rical.html" onclick="window.open(this.href);return false;

Lead (same) -

http://www.kitcometals.com/charts/lead_historical.html" onclick="window.open(this.href);return false;

Zinc (same) -

http://www.kitcometals.com/charts/zinc_historical.html" onclick="window.open(this.href);return false;

...coupled with this knowledge

Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly

http://www.zerohedge.com/article/goldma ... d-monopoly" onclick="window.open(this.href);return false;

Hedge funds look for a golden edge

http://www.ft.com/cms/s/0/f1b2691e-8b80 ... z1Z60lWLrK" onclick="window.open(this.href);return false;

Analysis: Hedge funds catch new wave in commodities

http://www.reuters.com/article/2010/10/ ... O720101001" onclick="window.open(this.href);return false;

Hedge Funds, Institutions to Increase Commodity Investments, Barclays Says

http://www.bloomberg.com/news/2010-12-0 ... -says.html" onclick="window.open(this.href);return false;

...so while the economy has spiraled down since 2008 (falling demand despite China's empty cities)....the investment funds have played games until the writing is clearly on the wall and we are about to hit the next big wave in deflation picking up where we left off in 2008. The PM groupies will take it as a buying opportunity - best o'luck to them. I have a sneaking suspicion though that the buying opportunity (value of FRNs to PMs) will be much much better in 6-12 months. What are people going to pay back their debt with??? gold/silver....that would be a negative. Sure they can exchange the gold/silver for dollars....but the debt must be satisfied in dollars. Just like the European Central bank borrowing dollars to shore up liquidity. When it comes time to satisfy the debt.....gonna be ugly. There will be a Day of Reckoning on debt!

Again catch the comments at the end of the video....

How else do we recover from the mess we’re in.

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

Well the big boys are planning blockchain digital currency, social credit, population reduction, and some sort of debt reset (satan's version of the millennium)....although on that last one I've never read a very coherent thought process or game plan on how they will accomplish that. Sure cyber attack on the banks and such...but nothing concrete as to how exactly that will work. I can't imagine them letting everyone off the debt hook after working for over a century to get to this point...but it's a real monkey with it's hand in the coconut unwilling to let go of the rice kind of thing...BeNotDeceived wrote: ↑January 27th, 2023, 6:38 pmJason wrote: ↑January 27th, 2023, 6:27 pmMake a few of those coins...hand them out to the debt holders and wish them luck!BeNotDeceived wrote: ↑January 27th, 2023, 4:09 pmJason wrote: ↑September 26th, 2011, 2:09 pm

http://www.opednews.com/articles/2/Assu ... 4-756.html" onclick="window.open(this.href);return false;

...couple that knowledge/understanding of the money creation system with this outlook -

http://www.youtube.com/v/aC19fEqR5bA

....as well as the recent triggers that have been pulled -

http://www.zerohedge.com/contributed/sp ... and-diesel" onclick="window.open(this.href);return false;

http://www.zerohedge.com/news/guest-pos ... ers-copper" onclick="window.open(this.href);return false;

Latest and greatest on copper -

http://www.kitcometals.com/charts/coppe ... large.html" onclick="window.open(this.href);return false;

Aluminum (look at 60 day, 6 month, 1 year, and 5 year charts to analyze the trend) -

http://www.kitcometals.com/charts/alumi ... rical.html" onclick="window.open(this.href);return false;

Nickel (same) -

http://www.kitcometals.com/charts/nicke ... rical.html" onclick="window.open(this.href);return false;

Lead (same) -

http://www.kitcometals.com/charts/lead_historical.html" onclick="window.open(this.href);return false;

Zinc (same) -

http://www.kitcometals.com/charts/zinc_historical.html" onclick="window.open(this.href);return false;

...coupled with this knowledge

Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly

http://www.zerohedge.com/article/goldma ... d-monopoly" onclick="window.open(this.href);return false;

Hedge funds look for a golden edge

http://www.ft.com/cms/s/0/f1b2691e-8b80 ... z1Z60lWLrK" onclick="window.open(this.href);return false;

Analysis: Hedge funds catch new wave in commodities

http://www.reuters.com/article/2010/10/ ... O720101001" onclick="window.open(this.href);return false;

Hedge Funds, Institutions to Increase Commodity Investments, Barclays Says

http://www.bloomberg.com/news/2010-12-0 ... -says.html" onclick="window.open(this.href);return false;

...so while the economy has spiraled down since 2008 (falling demand despite China's empty cities)....the investment funds have played games until the writing is clearly on the wall and we are about to hit the next big wave in deflation picking up where we left off in 2008. The PM groupies will take it as a buying opportunity - best o'luck to them. I have a sneaking suspicion though that the buying opportunity (value of FRNs to PMs) will be much much better in 6-12 months. What are people going to pay back their debt with??? gold/silver....that would be a negative. Sure they can exchange the gold/silver for dollars....but the debt must be satisfied in dollars. Just like the European Central bank borrowing dollars to shore up liquidity. When it comes time to satisfy the debt.....gonna be ugly. There will be a Day of Reckoning on debt!

Again catch the comments at the end of the video....

How else do we recover from the mess we’re in.

- BeNotDeceived

- Agent38

- Posts: 9058

- Location: Tralfamadore

- Contact:

Re: Inflation vs. Deflation debate

Would Jesus print the coin or not.Jason wrote: ↑January 27th, 2023, 7:05 pmWell the big boys are planning blockchain digital currency, social credit, population reduction, and some sort of debt reset (satan's version of the millennium)....although on that last one I've never read a very coherent thought process or game plan on how they will accomplish that. Sure cyber attack on the banks and such...but nothing concrete as to how exactly that will work. I can't imagine them letting everyone off the debt hook after working for over a century to get to this point...but it's a real monkey with it's hand in the coconut unwilling to let go of the rice kind of thing...BeNotDeceived wrote: ↑January 27th, 2023, 6:38 pm

How else do we recover from the mess we’re in.

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

render unto Caesar....things may naturally take care of that before He needs to be concerned with it...BeNotDeceived wrote: ↑January 27th, 2023, 7:09 pmWould Jesus print the coin or not.Jason wrote: ↑January 27th, 2023, 7:05 pmWell the big boys are planning blockchain digital currency, social credit, population reduction, and some sort of debt reset (satan's version of the millennium)....although on that last one I've never read a very coherent thought process or game plan on how they will accomplish that. Sure cyber attack on the banks and such...but nothing concrete as to how exactly that will work. I can't imagine them letting everyone off the debt hook after working for over a century to get to this point...but it's a real monkey with it's hand in the coconut unwilling to let go of the rice kind of thing...

pave the streets with gold when the time comes...

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

...switching gears again as the deals, bargains, sales, discounts, coupons, free shipping, etc... pick up...Jason wrote: ↑January 27th, 2023, 7:13 pmrender unto Caesar....things may naturally take care of that before He needs to be concerned with it...BeNotDeceived wrote: ↑January 27th, 2023, 7:09 pmWould Jesus print the coin or not.Jason wrote: ↑January 27th, 2023, 7:05 pmWell the big boys are planning blockchain digital currency, social credit, population reduction, and some sort of debt reset (satan's version of the millennium)....although on that last one I've never read a very coherent thought process or game plan on how they will accomplish that. Sure cyber attack on the banks and such...but nothing concrete as to how exactly that will work. I can't imagine them letting everyone off the debt hook after working for over a century to get to this point...but it's a real monkey with it's hand in the coconut unwilling to let go of the rice kind of thing...

pave the streets with gold when the time comes...

https://www.zerohedge.com/economics/and ... es-sliding

- Original_Intent

- Level 34 Illuminated

- Posts: 13077

Re: Inflation vs. Deflation debate

O mighty thread, highly favored among LDSFF conversations, I resurrect thee!

- Jason

- Master of Puppets

- Posts: 18296

Re: Inflation vs. Deflation debate

Certainly a thrill ride that's not over yet...deflation in discretionary and inflation in the necessary...

Credit cards tapped to the max at interest rates that are simply unsustainable...and when the credit stops???

Banks cracking down and limiting or pulling corporate credit lines...but credit cards so far seem to be holding out...another 2 months? 4 months? 6 months? ...then what?

supply lines for the current lifestyle are incredibly fragile...and wickedness is chaos...highly disruptive....

communications out of France appear to have just stopped a couple days ago....

...and the conspiracy keeps trying to move the ball forward...

...and of course the natural side of things are picking up...

https://www.volcanodiscovery.com/erupti ... anoes.html

Credit cards tapped to the max at interest rates that are simply unsustainable...and when the credit stops???

Banks cracking down and limiting or pulling corporate credit lines...but credit cards so far seem to be holding out...another 2 months? 4 months? 6 months? ...then what?

supply lines for the current lifestyle are incredibly fragile...and wickedness is chaos...highly disruptive....

communications out of France appear to have just stopped a couple days ago....

...and the conspiracy keeps trying to move the ball forward...

https://www.space.com/spacex-starlink-g ... ing-launchA Falcon 9 topped with 22 of SpaceX's next-generation Starlink internet satellites is scheduled to lift off from Cape Canaveral Space Force Station in Florida Sunday at 11:58 p.m. ET (0358 GMT on July 10). It will be the unprecedented 16th mission for the rocket's first stage, according to SpaceX.

...and of course the natural side of things are picking up...

https://www.volcanodiscovery.com/erupti ... anoes.html

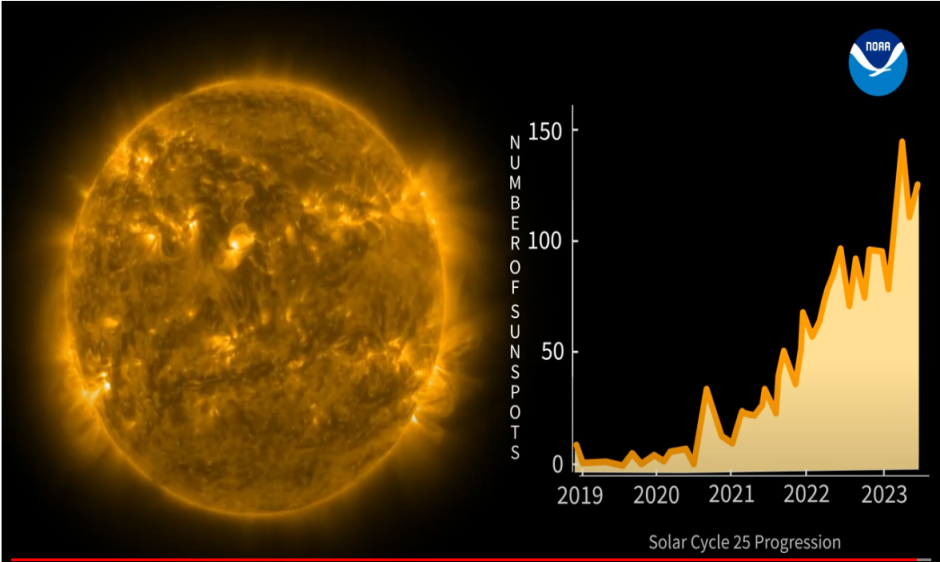

https://www.spaceweather.com/NOAA forecasters have increased the odds of a flare today (40% M-class, 5% X-class) in response to developments inside sunspot AR3361. The active region has an increasingly unstable 'beta-gamma-delta' magnetic field that harbors energy for strong explosions. Any flares will be geoeffective as the sunspot is directly facing Earth.

- Original_Intent

- Level 34 Illuminated

- Posts: 13077

Re: Inflation vs. Deflation debate

One thing I have learned over the years of watching the economy.

It is neither inflation or deflation that is the Destroyer - the wilder and more frequent the swings between them, the better it is for the insiders as it is the FOREKNOWLEDGE of which way the policy will be pushed that is wielded against us plebes.

As you stated, they are even managing to cause inflation in the necessities and deflation in the luxuries. Keeping housing and stocks inflated for the time being - that bubble is gonna burst eventually. A flock of black swans on the horizon...

It is neither inflation or deflation that is the Destroyer - the wilder and more frequent the swings between them, the better it is for the insiders as it is the FOREKNOWLEDGE of which way the policy will be pushed that is wielded against us plebes.

As you stated, they are even managing to cause inflation in the necessities and deflation in the luxuries. Keeping housing and stocks inflated for the time being - that bubble is gonna burst eventually. A flock of black swans on the horizon...